[1]Hina Almas and [2]MuashirMukhtar

Abstract

Microfinance provides strength to boost the economic activities of low-income group people and thus contributes to the eradication of their poverty. Research has highlighted the role of microfinance institutions in reducing the sufferings of poor. Microfinance institutions strive to alleviate poverty at the risk of their financial sustainability. In this regard Pakistani Microfinance institutions are also facing the problem of their sustainability while serving the poor people. This paper investigates the level of subsidy dependence and outreach for measuring microfinance institutions impact and poverty outreach. Moreover, this paper also compares subsidy dependence index and financially self-sufficiency index, explaining the objectives and limitations of each of them. While numerous researches have been conducted indifferent countries to study this issue, but no such study have yet been done in Pakistan’s context. For this study we have focus on eight microfinance institutions working in Pakistan. Sample institutions comprise of conventional and Islamic microfinance institutions. Data for this research have been drawn from financial statements of microfinance institutions and mix market website, from 2006 to 2012.Findings of this study have thrown some light on microfinance institutions financial sustainability while fulfillment of their promise of poverty reduction. Thus, the combination of subsidy dependence index and outreach index can play a vital role as regulatory and supervisory tool for microfinance institutions

- Introduction

The curse of poverty had remained a significant problem throughout the history of civilizations. Even in this era of development at least one third of the world population is suffering from the problem of poverty. With such a huge number of human beings living in such a deprived situation, it becomes very crucial to target this issue and search out feasible ways to overcome it.

Microfinance has come about to be one of the important tools for reducing poverty. It offers a solution by stimulating economic growth and development. Established microfinance institutions use many instruments to fulfill their promise of poverty reduction. One of those instruments is microcredit. Through this instrument microfinance institutions provides smallscale loans to individuals or groups so that the borrower could initiate their business and break out of poverty cycle.

Historically microfinance institutions have been playing their role in many formal and informal ways. There were many savings and credit groups in Ghana, India, Mexico, Indonesia, Sri lanka, West Africa etc. locally known as; susus, chit funds, tandas, arisan, cheetu, tontines etc. respectively. In the recent era of economic development the prominence of formal microfinance institutions came in the latter half of twentieth century. With the establishment of ACCION International in Latin America and Grameen Bank of Muhammad Yunusin Bangladesh in 1960’s and70’s, microfinance approach made its place in economic policies for poverty reduction. Grameen bank has provided loans of $9.1 billion to poor and spread their business to 37 countries. Muhammad Yunus was given noble prize for his services in 2006.

However, microfinance sector has been currently facing many challenges especially of mission drift. Institution started as to fulfill social cause has now slipped into the direction of profit maximization. When microfinance institutions focus their attention on social objectives they have to face the risk of financial unsustainability.MFIs need to be economically viable and sustainable in the long run but at the same time they must consider economic implications of long-term sustainability, which are not being considered, (Srinivasan et al., 2006).

The microfinance revolution and the remarkable development of the Microfinance industry in scale and scope raise demands for increased justification on the utilization of scarce public funds. In order to allocate these resources in the most efficient way, performance evaluation should reveal an accurate and meaningful picture of the performance of MFI in terms of reaching the objectives desired by society and the efficiency in developing products and services to the target recipients (Yaron and Manos, 2008).

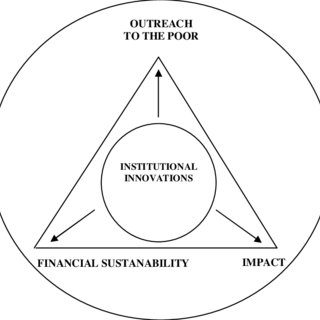

While a vast amount of literature exists on the trade-off between outreach depth and financial sustainability, much less research has been done in the field of how successful MFIs designed their institutions to bridge this trade-off (Woller, 2004).MFIs must fulfill their promise of poverty reduction but at the same time they should be financially sustainable, as well. Same situation exists in the case of Pakistan, where there is tradeoff between poverty outreach and financial sustainability. Studies show that if preference of MFIs is to serve the poor than financial sustainability will be difficult due to high transaction cost. This research is to investigate these issues in Pakistan’s context.

The objective of this study is to explore and provide a methodology which recognizes those MFIs which achieve the goal of poverty reduction while remaining financially sustainable. Also this study provides a benchmark and methodology to investors and donor agencies to direct their funds towards self-sufficient and socially targeted MFIs. Thus this study will help in accelerating the economic growth and development of the country.

For this purpose we have taken up the approach of Yaron (1992) in which he has advocated for studying the performance of MFI through the dual concept of outreach and sustainability, seeking the breadth and depth of the institution. For measuring the outreach, Yaron has proposed for Outreach Index (OI) and for measuring the sustainability or self-sufficiency he has proposed for Subsidy Dependence Index (SDI). Thus the combination of OI and SDI gives more reliable measure of performance of MFI. In contrast to this we have also calculated one of the leading methodologies for measuring the performance of MFIs i.e. Financial Self-Sufficiency (FSS) and compared its results with SDI and OI.

This study is further divided in five sections. Starting from literature review which discusses the theoretical foundation and provides the framework empirical study, it continues on the methodology and data collection. Section four elaborates on the results and highlights the important facts for consideration. Section five concludes the study with policy implication and further research direction. Tables of data collected of each microfinance institution are attached as annexure.

- Literature Review

Microfinance is an important way of building the potentials of the poor who are mostly ignored by other financial institutions. Social objectives of microfinance are defined as “the effective translation of an institution’s social goals into practice in line with accepted social values; these include sustainably serving increasing number of poor people, improving the quality and appropriateness of financial services and improving the economic and social conditions of clients”[3]. Social performance is being measured by using some variables as proxies like number of borrowers, average loan size, percentage of female borrowers, etc. Economic performance can be measured by subsidy dependence index and financial selfsufficiency index. SDI can be measured by subsidy received by microfinance institutions; loan portfolio and weighted average index on loan portfolio whereas FSS can be measured by Adjusted Financial Expense, Adjusted Net Loan Loss Provision Expense, Adjusted Operating Expense and Adjusted Finical Revenue.

The microfinance industry is characterized by a “schism” (Murdoch 2000), which spurs debate between two streams of thought. On the one hand are institutionalisms that focus on achieving financial self-sufficiency by outreaching in scale (targeting more the marginally poor), while, on the other hand, welfarists emphasize outreach in depth and social impact and attribute an important role to subsidies. While institutionalisms regard “subsidized” institutions as inherently inefficient (Murdoch 1999, Hollis 1998), welfarists argue that all crucial microfinance innovations came from flagship institutions such as Grameen Bank, ACCION and FINCA, which were heavily dependent on donor funding at the time of innovation (Murdoch 1999, Hollis 1998).

Despite the fact that there is a common understanding on the importance of financial performance and gradual strive towards sustainability, the debate goes on with regard to fulfilling the promise of microfinance in targeting the “poorest” of the poor (Tucker, 2011).Various surveys such as the one conducted in Bolivia show that the majority of households reached by MFIs were near the poverty line. That means that they rather reached the marginally poor than the very or rural poor(Navajas, 2000).

This opened the debate on the depth of outreach and Schreiner (1999) aided discussions by proposing a framework that defines the six dimensions of outreach such as length, breath, scope, cost, depth and worth. Length of outreach can be described as “microfinance supply in a particular time frame”. In this time frame present and future both are included. Breath of outreach can be defined as “number of clients”. Breath depends upon the funds supplied to the clients, if all other factors are kept constant. Scope of outreach is “number of types of financial contracts supplied”. Cost of outreach can be stated as “sum of price cost and transaction cost”. Price cost is cost which is directly paid in the form of cash for interests and fee whereas transaction cost is non-price cost for indirect cash expenses Depth of outreach he argues is the preference of society towards recipients of funds. As direct measurement through income or wealth is difficult, Schreiner (1999) proposes indirect proxies for depth such as gender and location. In gender women are given preference and in location, rural are preferred (Schreiner, 1999).

Deepening outreach accordingly means to extend services to women and to remote rural areas. Rural finance, however, usually triggers high transaction costs and increased risk due to dispersion. High transaction cost and risk thus often serve as an argument by those focusing on sustainability against reaching out to remote rural areas. During the past ten years considerable concern arose over the increasing emphasis on financial performance as this often served as legitimization for drifting from the original social mission in servicing the very poor(Buchenau and Mayer, 2007).

The significant development of the Microfinance industry resulted in a broad spectrum of microfinance institutions ranging from organizations that regard social objectives only as byproducts to those who focus on translating their missions into practice. Measurement of success of microfinance institutions accordingly depends on the intent (mission) and design of the MFI, the selection of specific target segments (Dunford, 2000). The design of appropriate methodologies to translate mission into practice while gradually achieving cost recovery and subsidy independence accordingly is of utmost importance (Ledgerwood, 1999; Nitin, 2001).

Cull et al. (2006) studied that to what extent the MFIs can earn profit when they are also targeting the poor. His main objective was to find a relationship between financial performance and poverty outreach of MFIs. He used data between 1999 and 2002. 124 MFIs (village banks, individual-based lenders, and group-based lenders) from 49 developing countries were studied by using FSS, unadjusted measure of OSS and ROA.From this study he found out that when interest rates rise to high levels, it does not cause greater profitability or cost minimization.Individual based lenders which charge higher interest rate and high labor cost earn more profit.No important relationship is found between labor cost and profitability.Designs of institutions play significant relationship between tradeoff between outreach and profitability of institutions (Cull et al. 2006).Stieglitz and Weiss gave similar statement that raising interest rates will undermine portfolio quality due to adverse selection and moral hazard. Further studies provedthat individual-based lenders that charge higher interest rates are more profitable than group lenders but only up to some extent.When interest rate reaches threshold level, profitability starts decreasing.In case of group based lenders profit does not increase with the rise in yield. Those individual lenders which charge high labor cost gain more profit.There was no important relationship found between labor cost and profitability for group lenders.They also found that it is not necessary that institutions with smaller loans will earn less profit (Stieglitz and Weiss, 1981).

Subsidy is very substantial to measure the sustainability of Microfinance institutions. A large number of microfinance programs in the world are subsidized in different ways, sustainability of the programs poses a question in the mind of academics and researchers. Grameen Bank of Bangladesh has to face high repayment rate but also have to depend upon subsidies (Morduch 1999).

Seibel and Torres (1999) stated that sustainability of Grameen type MFI with the substantial increase in outreach is possible butthis can be done only at the cost of subsidy. Yaron (1992) proposed Subsidy Dependence Index (SDI) for the first time. According to Hulme and Mosley (1996), SDI measures subsidy dependence and limit to which lending interest rate should be raised to cover all the operating costs of MFIs. Consequently the notion of a subsidy free break-even rate for MFIs provides the argument for the upward revision in interest rates to poor borrowers.

Yaron (1992) calculated SDI by a ratio of subsidy and loan portfolio and result is multiplied by lending rate of interest. The most interesting calculation part of the index is subsidy where it comprises of a number of cost revenue and cost components. Hulme and Mosley (1996) introduced advanced version of SDI formula by using simpler calculations and new notations. Kahndakar and Khalily (1995) suggested that SDI ratio more clearly explains the financial sustainability of MFIs. According to them SDI index compares subsidy only with revenue from lending however revenue from investments in non-loan assets (treasury bills) should also be considered.

Financial self-sufficiency index is also used for measuring the self-sufficiency of microfinance institutions.FSS has many deficiencies as compared to SDI.FSS does not include opportunity cost of capital, it doesn’t differentiate between MFIs that target poverty and the MFIs which invest their fund in other businesses and it tends to under estimate the subsidy dependence of microfinance institutions (Yaron and Manos, 2008).

In Table:1 we have presented a detailed view on some current methodologies for evaluating MFIs performance. Along with it we have discussed the limitations of each technique, to present a comparative analysis of each.

Table: 1: Methodologies for Evaluating MFI

| Techniques | Objective | Limitations |

| Difference-in-

Difference (DID) |

To assess the impact of the microfinance program on various outcomes. | Failure to take into account externalities and spillover effects, and the differencing nets out the effect of the comparison group. |

| Stochastic Frontier Analysis (SFA) | To estimate the cost function for MFIs. | This method inherently renders biased coefficients. |

| Operational Self-

Sufficiency(OSS) |

It shows that to cover MFI direct cost, is revenue enough or not? It includes only financial cost but excludes

cost of capital |

OSS only covers operating income and operating expenses along with the provision of loan loss. |

| Financial Self –

Sufficiency (FSS) |

To portray financial health of MFIs. | FSS measure tends to underestimate the subsidy dependence of the MFI |

| The Break Even Condition | In depth economic analysis of the institution. | It is a simple technique and it can work in only stable economic conditions whereas revenues and costs change with passage of time. Hence it is not effective for volatile conditions. |

| Data Envelopment Analysis (DEA) | It measures that how much MFIS are cost efficient. | It cannot control measurement errors and other random effects |

| The Return on Assets (ROA) and the return on equity (ROE) | To measure the performance of MFIs | They ignore the subsidies received by MFIs and opportunity cost of capital |

| Discounted Cash Flow (DCF) method | To measure the performance of microfinance institutions. | It requires the implementation of a different data collection system to that which the organization uses to generate

its financial statements |

| Economic Value Added (EVA) | It measures the excess of the profit over return required by the suppliers of capital | It requires accounting figures are adjusted tomeasure the profit more accurately. |

| SDI | To measure the subsidy dependence of microfinance institutions. | It does not measure the subsidy that MFIs gets by revenue from investments in nonloan assets like treasury bills, etc. |

| OI | To measure the poverty outreach of microfinance institutions. | NIL |

- Methodology

- Problem Statement:

Microfinance institutions strive to reduce sufferings of poor. This target is difficult to achieve because microfinance institutions have to pay a high cost to reach their poor clients. Only those microfinance institutions may achieve their objectives, which are financially sustainable themselves. It is very necessary to find those MFIs, which are able to reduce poverty while remaining financially sustainable. We will measure the performance of microfinance institutions by SDI and OI.SDI index is used for measuring the self-sufficiency of microfinance institutions and OI is used to measure the outreach of microfinance institutions

- SDI:

In measuring the magnitude of subsidy dependence of respective microfinance institutions, this paper uses subsidy dependence model developed by Yaron(1992).For calculation of SDI, it is necessary to aggregate all subsidies received by all MFI and compare it to total loan revenues, being the product of the banks on lending interest rate or profit rate and the average annual loan portfolio(LP).This can be mathematically expressed as

SDI = S/LP*i

Where SDI is the index of subsidy dependence; LP is the average outstanding loan portfolio and I is the weighted average on lending rate paid on loan portfolio. (Yaron and Manos, 2007)

The amount of the annual subsidy received by the MFI is defined as:

S = A (m – c) + [(E * m) – P] + K

Where:

S = Annual subsidy received by the MFI

A = MFI concessionary borrowed funds outstanding (annual average)

m = The assumed interest rate that the MFI would have to pay for borrowed funds if access to concessionary borrowing was eliminated.

c = Weighted average annual concessionary rate of interest actually paid by the MFI on its annual average concessionary borrowed funds outstanding

E = Average annual equity

Data was collected from microfinance institutions financial statements available online at Mix Market website and from annual reports. SDI for different years from 2006 to 2012 was calculated .The sample contain seven conventional and one Islamic Microfinance institution.

3.3. OI:

Yaron (1992) proposed use of outreach index along with SDI for measuring the outreach of microfinance institutions. OI index measures the output of financial support provided to Microfinance institutions. Use of SDI along with OI is beneficial for measuring both the subsidy dependence and outreach of microfinance institutions. There are different variables which are required to calculate outreach index for example number of loans, amount of loans, income group, total amount per income group etc. The weighted output index (OIw) is then expressed as:

OIw

Where (Li),is income size groups the non-weighted output index (OInw) is expressed as:

OInw

The ratio Z = OInw / OIw should be interpreted as a “discount factor” thus

Z=

We have first calculated OI index with actual weight ratio (ratio calculated from male and female borrowers and similarly urban and rural borrowers) than we have changed the weight ratio to 0.6 and 0.4 and in the end we have calculated the OI index with fixed 0.5 ratios. Results are shown in 4.3 sections. We have obtained data from financial statements of microfinance institutions.

3.4. FSS:

Financial Self-Sufficiency is an important measure of sustainability of the lending operation. FSS index is also used to measure the self-sufficiency of microfinance institutions. It has helped in giving us a comparison statement between using SDI, OI and FSS. We have followed the formula of FSS

FSS =

Data of all variables is obtained from financial statements of microfinance institutions given on mix market website. Results and graphs are given in section 4.4.

Financial Self-Sufficiency indicates whether or not enough revenue has been earned to cover both, direct costs- including financing costs, provision for loan losses and operating expenses and indirect costs including the adjusted cost of capital.

3.5. Comparison of SDI and FSS:

3.5.1. Table: 2: Comparison between FSS & SDI

| FSS | SDI |

| This index ignores the opportunity cost of equity. Hence it cannot evaluate those MFIs,whose opportunity cost of equity changes over time. | It includes all financial resources including opportunity cost of equity. Hence this index gives the exact measurement of opportunity cost of capital without overestimating the self-sufficiency of Microfinance institutions. |

| It does not include exemptions from RR | It includes exemptions from RR |

| FSS cannot distinguish between MFIs that invest their assets in loan portfolio and those MFIs, which incorporate their assets in other investments. | SDI can easily differentiate between MFIs that invest their assets in loan portfolio and those MFIs, which incorporate their assets in other investments. |

| FSS index fails to evaluate the growth of MFIs toward their subsidy

independence, when MFIs starts relying on the concessionary borrowing. |

SDI index can show the progress of MFIs toward the subsidy independence because this index entirely calculates the subsidies received by MFIs.[4] |

3.6. Data:

Data was collected from financial statements of microfinance institutions, given on mix market website. Data of eight microfinance institutions was used from 2006 to 2012.There are seven conventional and one Islamic microfinance institutions working in Rawalpindi/Islamabad, whose data was used. All of these MFIs have range of ownership pattern, size, management, methodology, source of funding etc

- CALCULATIONS AND DISCUSSION:

- SDI Measurement Models: Results and Findings:

Table: 3: SDI for different MFIS from year 2006 to 2012

| YRS

|

KASHF Bank | NRSP Bank | Khushali Bank | FMFB | Pak

Oman MFB |

KASHF

Foundation |

BRAC-AK | Akhuwat Bank |

| 2006 | – | 0.0181 | -0.0047 | 0.0102 | -0.01740 | – | 0 | |

| 2007 | – | – | 0.0137 | 0.0073 | 0.0127 | -0.05838 | – | 0 |

| 2008 | 0.01165 | – | -0.050 | 0.0123 | 0.0962 | 0.059511 | 0.00056 | 0.0368 |

| 2009 | 0.06086 | – | 1.1070 | 0.0051 | 1.6412 | 0.342643 | -2.6395 | 0.0244 |

| 2010 | 0.20818 | 0 | 0.78179 | 0.0424 | -0.023 | 0.000629 | -0.0200 | 0.0400 |

| 2011 | 0.12055 | 0.095 | 0.1837 | 0.0276 | 1.6458 | -0.17589 | 0.04568 | 0.00012 |

| 2012 | 0.04487 | -0.09 | 0.0714 | 0.0006 | 2.6923 | -0.14432 | 0.04681 | 0.00012 |

4.1.1. GRAPHS:

Figure 1: Kashf Bank Increasing Trend Figure 2:NRSP Increasing Trend

Figure3: Khushali Bank Increasing Trend Figure4: Khushali Bank Increasing Trend

Figure 5: POMF Bank Increasing Trend Figure 6:Kashf Foundation Decreasing Trend

Figure 7: BRAC BANK Increasing Trend Figure 8:Akhuwat Bank Decreasing Trend

SDI was calculated by using the formula of SDI(mentioned above).Variables used for each MFI are average outstanding loan portfolio, lending rate paid on loan portfolio, annual subsidy received by the MFI, MFI concessionary borrowed funds outstanding, assumed interest rate that MFI would have to pay for borrowed funds, weighted average annual concessionary rate of interest actually paid by MFI on its average annual concessionary borrowed funds outstanding, average annual equity. Data of all variables is given in income statements of microfinance institutions given on mix market website except subsidy. Subsidy was calculated by using the formula of subsidy (mentioned above).SDI of all MFIs range from 0 to 1.SDI of KASHF bank ranges from 0.01165 to 0.0487.It shows increasing trend. SDI of NRSP bank ranges from0.095 to -0.091.It shows Increasing trend.SDI of Khushali bank ranges from 0.0181 to 0.0714.It shows increasing trend.SDI of First microfinance bank ranges from .0.0047 to 0.0006. It shows increasing trend.SDI of Pak Oman microfinance bank ranges from 0.0102 to 2.6923.It shows increasing trend.SDI of KASHF foundation ranges from -0.01740 to -0.14432.It shows decreasing trend.SDI of BRAC bank ranges from 0.00056 to 0.04681.It shows increasing

trend.SDI of Akhuwat bank ranges from 0 to 0.00012.It shows decreasing trend.0 to 1 range of SDI shows that results are satisfactory.

4.2. OI Measurement Models: Results and Findings:

4.2.1. With weight ratio calculated.

Table: 4: OI for different MFIS from year 2006 to 2012 with actual Weight ratio

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

| Khushali Bank | 0.66 | 0.64 | 0.62 | 0.66 | |||

| Society benefit | Society benefit | Society benefit | Society benefit | ||||

| NRSP Bank | 0.92 | 0.83 | |||||

| Society benefit | Society benefit | ||||||

| KASHF Bank | 0.96 | 0.96 | 0 | 0.97 | |||

| Society benefit | Society benefit | Society benefit | Society benefit | ||||

| FMFB Bank | 0.55 | 0.57 | 0.59 | 0.59 | 0.54 | ||

| Society benefit | Society benefit | Society benefit | Society benefit | Society benefit | |||

| POMFB Bank | 0.66 | 0.64 | 0.60 | 0.59 | |||

| Society benefit | Society benefit | Society benefit | Society benefit | ||||

| KASHF

Foundation |

0.75 | 0.75 | |||||

| Society benefit | Society benefit | ||||||

| BRAC Bank | 0.76 | 0.81 | 0.78 | 0.78 | |||

| Society benefit | Society benefit | Society benefit | Society benefit | ||||

| AKUWAT Bank | 0.78 | 0.78 | 0.78 | 0.77 | |||

| Society benefit | Society benefit | Society benefit | Society benefit |

4.2.2. With 0.6 and 0.4 weight ratios:

Table: 5: OI for different MFIS from year 2006 to 2012 with 0.6 & 0.4 Weight ratio

| 2006 | 2007 | 2008 | 2009 | 2011 2012 | ||||

| Khushali Bank | 0.60 | 0.59 | 0.59 0.59 | |||||

| Society benefit | Society benefit | Society benefit | Society benefit | |||||

| NRSP Bank | 0.644137 | 0.63292199 | ||||||

| Society benefit | Society benefit | |||||||

| KASHF Bank | 0.44 | 0.44 | 0 | 0.44 | ||||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | |||||

| FMFB Bank | 0.50 | 0.58 | 0.59 | 0.59 | 0.56 | |||

| Society benefit | Society benefit | Society benefit | Society benefit | Society benefit | ||||

| POMFB Bank | 0.47 | 0.47 | 0.49 | 0.49 | ||||

| Society not benefit | Society not benefit | Society not benefit | Society notbenefit | |||||

| KASHF

Foundation |

0.45 | 0.44 | ||||||

| Society not benefit | Societynot benefit | |||||||

| BRAC Bank | 0.42 | 0.39 | 0.40 | 0.40 | ||||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | |||||

| AKUWAT

Bank |

0.41 | 0.41 | 0.42 | 0.416 | ||||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | |||||

4.2.3. With fixed 0.5 weight ratio:

Table: 6: OI for different MFIS from year 2006 to 2012 with 0.5 Weight ratios

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

| Khushali Bank | 0.5 | 0.5 | 0.5 | 0.5 | |||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | ||||

| NRSP Bank | 0.5 | 0.5 | |||||

| Society not benefit | Society not benefit | ||||||

| KASHF Bank | 0.5 | 0.5 | 0 | 0.5 | |||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | ||||

| FMFB Bank | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | ||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | Society not benefit | |||

| POMFB

Bank |

0.5 | 0.5 | 0.5 | 0.5 | |||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | ||||

| KASHF

FOUNDATIO N |

0.5 | 0.5 | |||||

| Society not benefit | Society not benefit | ||||||

| BRAC Bank | 0.5 | 0.5 | 0.5 | 0.5 | |||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit | ||||

| AKUWAT

Bank |

0.5 | 0.5 | 0.5 | 0.5 | |||

| Society not benefit | Society not benefit | Society not benefit | Society not benefit |

The society will benefit when subsidy is equally distributed among male and female and rural and urban community as four cases are considered for this study.

The results calculated from actual weight ratio are not up to the mark because for actual weight ratio subsidy distributed among other communities are also taken in account but due to non-availability of data we taken only four categories that’s why results are not appropriate.

The results calculated from 0.5-weight ratio are also not up to the mark because equal distribution among all categories is not possible.

The results calculated from 0.6 and 0.4 weight ratio are satisfactory because the MFIs which have better distribution between male and female and similarly rural and urban, will ultimately lead society toward benefit which has also seen from calculation that Khushali, NRSP and FMFB lead society toward benefit.

4.3. FSS Measurement Models: Results and Findings:

Table: 7: FSS for different MFIS from year 2006 to 2011

| YEARS

|

KASHF Bank | NRSP Bank | Khushali Bank | FMFB | POMFB | KASHF

Foundation |

BRAC Bank | Akhuwat Bank |

| 2006 | – | – | 0.874 | 1.130 | 0.690 | 1.506 | – | 0.690 |

| 2007 | – | – | 0.813 | 0.892 | 0.642 | 1.551 | – | – |

| 2008 | 0.532 | – | 0.834 | 0.825 | 0.734 | 0.586 | 0.034 | 0.582 |

| 2009 | 0.516 | – | 1.033 | 1.019 | 0.861 | 0.097 | 0.614 | 0.326 |

| 2010 | 0.547 | 0.000109 | 1.139 | 0.885 | 1.047 | 0.775 | 0.655 | 0.186 |

| 2011 | 0.650 | 1.079 | 1.090 | 0.931 | 1.070 | 0.840 | 0.637 | 0.912 |

| 2012 | 0.752 | 1.140 | 1.031 | 0.954 | 0.989 | 0.997 | 0.718 | – |

4.3.1. GRAPHS

Figure 9: Kashf Bank Increasing Trend Figure 10: NRSP Increasing Trend

Figure 11: Khushali Bank Increasing Trend Figure12: FMFB Decreasing Trend

Figure 13: POMFB Increasing Trend Figure 14:Kashf Foundation Decreasing Trend

Figure 15: Brac Bank Increasing Trend Figure 16: Akhuwat Bank Decreasing Trend

Results show that KASHF bank, NRSP, Khushali bank, POMFB , BRAC bank are become more financially self-sufficient with passing years but First Microfinance bank limited, KASHF foundation, Akhuwat bank are showing decreasing trend. It shows that their financially selfsufficiency is decreasing with time.

- CONCLUSIONS:

- SDI index shows dependence of Microfinance institutions on subsidies.SDI of 0 shows that a microfinance institution is sustainable or we can say that the MFI is capable of covering all the subsidies (on borrowed funds) from its profit. A negative value of SDI shows that a MFI is completely self-sufficient and this particular MFI is also getting profit after covering its costs. Similarly the positive SDI value shows that MFI is not sustainable and in order to become sustainable, MFI has to increase its lending rate. In our case all the MFIs are showing different trend of their dependence on subsidies. Kashfbank, NRSP, Khushali bank, First microfinancebank, Pak Oman microfinance bank,BRACbank, all of these MFIs are showing increasing trend.This indicates that with passing years, they are relying more on subsidies. On the other hand KASHF foundation and Akhuwat foundations are showing deceasing trend. It shows that with time, they are become more sufficient and sustainable.

- When CW<C, it shows that more subsidies are allocated to lower income group of society, hence society benefit from subsidies. And when CW>C, it shows that targeting the lower income group requires more cost. Therefore society does not benefit from subsidies. We have calculated first OI with actual calculated weight ratios,then with 0.6 and 0.4 ratios and then with 0.5 weight ratio.In first case results show that society benefit from the subsidies.In second case, results show that in case of Khushalibank, NRSPbank, First microfinance bank, , more subsidies are allocated to lower income groups of society and society benefit from the subsidies but on the other hand BRAC bank, KASHFfoundation, Akhuwatfoundation, KASHF bank, Pak Oman microfinance bank, less subsidies are allocated to lower income groups of society and society does not gain from subsidies. In third case, results of all MFIs show that society does not get benefit from the subsidies and fewer subsidies are allocated to lower income group of society.

- Results show that KASHF bank, NRSP,Khushalibank, POMFB ,BRAC bank are become more financially self-sufficient with passing years but First Microfinance bank limited, KASHFfoundation, Akhuwat bank are showing decreasing trend. It shows that their financially self-sufficiency is decreasing with time.4

- Both the FSS and SDI show different results relating to the subsidy dependence of the same microfinance institutions.SDI results show that more MFIs are increasing dependence on subsidy while FSS results show that more MFIs are become financially self-sufficient with time which is not the case in reality because administrative costs are increasing with every year but yield on loan portfolio is not necessarily increasing. Hence we can say that FSS underestimates the subsidy dependence of microfinance institutions and does not depict the exact picture of subsidy dependence of microfinance institutions.

- Microfinance institutions should struggle to reduce operational cost. In this way, they will be more financially sustainable and will be able to target poor population more efficiently. If operational cost is large, and it is not covered with in their income, then MFIs cannot reach their clients in far off places because by doing so, they will be financially unsustainable.

REFERENCES:

[1]. Khavul, S., 2010. Microfinance: creating opportunities for the poor? Academy of Management Perspectives 24 (3), 58-72.

[2]. Srinivasan R. and Sriram, M.S. (2006), Microfinance in India: Discussion, IIMBManagement Reviewpp.66-86.

[3]. Manos, R., &Yaron, J. (2008). Key Issues in Assessing the Performance of Microfinance Institutions. Working Paper – The College of Management, Israel.

[4]. Woller, G. (2004). The cost-effectiveness of social performance assessment the case of Prizma in Bosnia- Herzegovina.Small Enterprise DevelopmentJournal, 15(3), 41–51.

[5]. Yaron, J., & Manos, R. (2007). Determining the Self-Sufficiency of Microfinance Institutions. Savings and Development, No 2, pp131-160…

[6]. Michael Tucker and Gerald Miles, “Financial Performance of Microfinance Institutions: A Comparison to Performance of Regional Commercial Banks by Geographic

Regions,”Journal of Microfinance, 6(1) 2004, 1-15.

[7]. International Journal of Economic Development, Vol. 1, No. 1, pp. 29-64.

[8]. Michael Tucker, Financial Performance of Selected Microfinance Institutions: Benchmarking Progress to Sustainability, Journal of Microfinance, 3(2) 2001, 107-123.

[9]. Navajas, Sergio and Schreiner, Mark and Meyer, Richard L. and Gonzalez-Vega, Claudio and Rodriguez-Meza, Jorge, Microcredit and the Poorest of the Poor: Theory and Evidence from Bolivia. World Development, Vol. 28, Issue 2, February 2000

[10]. Schreiner, Mark, 1999, Self-employment, microenterprise, and the poorest Americans, The Social Service Review 73, 496-523

[11]. Buchenau, Juan, and Richard L. Meyer, “Introducing Rural Finance into an Urban

Microfinance Institution: The Example of BancoProCredit El Salvador,” Paper presented at the International Conference on Rural Finance Research: Moving Results into Policies and Practice held at FAO, Rome, March 19-21, 2007.

[12]. Dunford, Christopher. 2000. “The Holy Grail of Microfinance: ‘Helping the Poor’ and sustainable?” Small Enterprise Development, 11 (1): 40-44

[13]. Ledgerwood, J., (1999), Microfinance Handbook: An Institutional and Financial Perspective, World Bank, Washington, D.C.

[14]. Michael Tucker and Gerald Miles, “Financial Performance of Microfinance Institutions: A Comparison to Performance of Regional Commercial Banks by Geographic

Regions, “Journal of Microfinance, 6(1) 2004, 1-15

[15]. Cull, R., Demirgüç-Kunt, A., Morduch, J., 2006. Financial Performance and Out- reach: A Global Analysis of Leading Microbanks, World Bank Policy Research Working Paper, 3827

[16]. Stiglitz, J, and Weiss, A., (1981). Credit Rationing in Markets with Imperfect Information. AmericanEconomic Review 71(3), 393–410.

[17]. Hulme, D. and Mosley, P., (1996), Finance Against Poverty Vol. 1, Routledge, New York, pp.16-26

[18]. Morduch, J., (1999), The Role of Subsidies in Microfinance: Evidence from the Grameen Bank, Journal of Development Economics, Vol. 60, No. 1, pp. 229–248.

[19]. Seibel, H.D. and Torres, D., (1999), Are Grameen Replicators Sustainable, and Do They Reach the Poor? The Case of Card Rural Bank in the Philippines, The Journal of Microfinance, Vol. 1, No. 1, pp. 117-130.

[20]. Yaron, J., (1992), Assessing Development Finance Institutions: A Public Interest Analysis, World Bank Discussion Paper No. 174, World Bank, Washington,.

[21]. Khandker, S.R. and Khalily, B., (1996), “The Bangladesh Rural Advancement

[1] Research Scholar, MS Economics and Finance, International Institute Of Islamic Economics(IIIE),International Islamic University Islamabad

[2] Research Assistant, Center for Entrepreneurial Development(CED),Institute Of Business Administration(IBA),Karachi,Pakistan.

[3] http://www.microfinancegateway.org/p/site/m/template.rc/1.11.48260

[4] Yaron And Manos(2007),Determining The Self Sufficiency Of Microfinance Institution.Saving and Development,No 2,PP 131-60